Managing finances is no easy task, but the 50 30 20 rule has emerged as a cornerstone budgeting strategy for Americans looking to enhance their savings growth by balancing needs, wants, and savings. However, simply being aware of this financial rule doesn’t guarantee fiscal success. It’s the smart spending and disciplined application of the rule that can have a significant impact on your financial stability. In this comprehensive guide, we delve into the depths of the 50 30 20 rule—decoding its nuances, evaluating its practicality, and designing a strategy to optimize its benefits for your personal economic landscape.

Key Takeaways

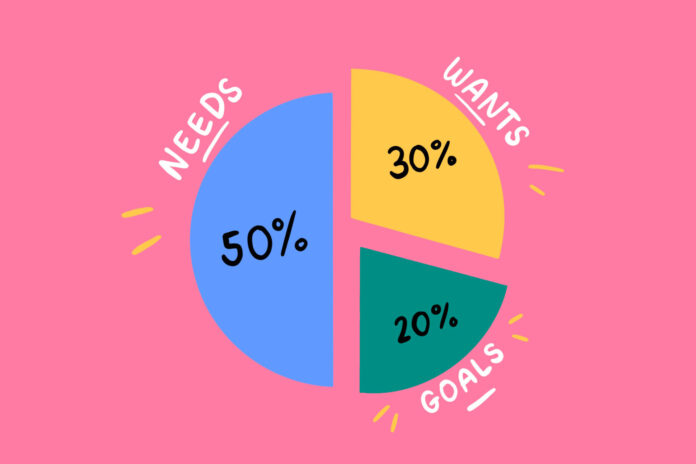

- The 50 30 20 rule is integral to establishing a balanced budget, distinguishing between essential costs and discretionary spending.

- Structuring your budget with 50% for needs, 30% for wants, and 20% for savings and debt repayment is foundational for financial wellness.

- Understanding your net income after deductions, such as taxes and health insurance, is crucial to applying the 50 30 20 rule effectively.

- Flexibility in the rule allows for personalization according to individual financial situations and goals.

- Implementing smart saving habits, even if starting small, can compound into substantial financial security over time.

- Using savings tools like high-yield savings accounts and Roth IRAs can greatly benefit your financial future.

- Consistent review and adjustment of your financial plan, considering unexpected expenses and income changes, ensures long-term viability of the 50 30 20 rule.

Introduction to the 50 30 20 Rule

The 50/30/20 budget rule, a budgeting technique lauded for its simplicity and effectiveness, works by dividing income into three primary categories: needs, wants, and savings. A modern approach to managing personal finances, this budgeting strategy is designed to optimize the allotment of after-tax income, establishing a well-structured financial plan that fosters both stability and growth.

As the statistics reveal, only 3.7% of the average person’s income in the United States, as of December 2023, was dedicated to savings, indicative of a potential need for improved budgeting strategies. The 50/30/20 rule addresses this by clearly stipulating that 50% of one’s after-tax income should be allocated to the essentials—needs—which include housing, such as rent or mortgage, as well as groceries, insurance, and utilities. These are the must-haves for daily living that are non-negotiables when it comes to budgeting.

Concurrently, the rule recommends dedicating 30% of the after-tax income to wants—the non-essential expenditures that contribute to quality of life, such as entertainment, dining out, and luxury items. This allocation allows for personal enjoyment, while still keeping discretionary spending in check to prevent potential financial strain.

The last slice of the income pie, 20%, is reserved for savings and investments, underlining the fundamental objective of the rule: to prioritize future financial well-being through building emergency funds, supporting retirement savings, and contributing to debt repayments. To ensure these contributions are not overlooked, the rule champions the automation of this process, which can lead to consistent growth in one’s savings without the need for manual transfers.

Understanding and applying the 50/30/20 rule means recognizing the delicate balance it aims to maintain between the immediacy of everyday expenses and the foresight necessary for long-term financial health. Its attraction lies in the provision of clear guidelines for tracking expenses, defining critical costs, and maintaining the discipline needed to adhere to this dividing income model. For illustrative purposes, take a monthly after-tax income of $5,000: the 50/30/20 rule would suggest $2,500 for mandatory expenses, $1,500 for discretionary spending, and $1,000 channeled into savings and debt repayment. Nonetheless, adjustments may be necessary for those with exceptional debt burdens or those living in high-cost areas.

Ultimately, the 50/30/20 budgeting strategy encourages a simplification of personal finance management by dividing income into broad but distinct categories. By doing so, individuals can develop a more robust understanding of their financial situation, allocating their after-tax income toward their needs, wants, and savings in a way that supports both current necessities and future aspirations.

The Origin and Popularity of the 50 30 20 Rule

The concept of the 50/30/20 budgeting rule has established itself as a cornerstone of financial management, largely due to the influence of U.S. Senator Elizabeth Warren and her seminal work, the book “All Your Worth: The Ultimate Lifetime Money Plan.” This popular budgeting rule delineates a clear and accessible strategy for managing one’s finances by categorizing spending into three essential segments.

In her book, Warren, with co-author Amelia Warren Tyagi, offers an approachable blueprint for individuals seeking to navigate their financial landscape with prudence and foresight. The rule’s simplicity allows for broad application, making it a staple recommendation by financial advisors and personal finance enthusiasts alike. It advises individuals to allocate 50% of their post-tax income to meet their needs, 30% for wants, and at least 20% must be set aside for savings or debt repayment.

For instance, under this model, someone earning a gross monthly pay of $5,000, after taxes, might find themselves with $4,000 available for budgeting. According to the 50/30/20 rule, $2,000 would be allocated toward essential needs such as housing, groceries, and minimum loan payments, while $1,200 would be designated for discretionary wants like dining out and entertainment, leaving a remaining $800 for critical savings or reducing debt.

However, the rule’s rigidity can be modified to suit individual financial situations, stressing the importance of adjusting these percentages to more accurately reflect one’s personal circumstances. For example, adjustments may include increasing the savings portion for someone behind on retirement contributions or trimming the wants section should essential expenses be considerably less than anticipated.

- An advocate of automation, the rule underscores the significance of directing a portion of income towards savings as soon as it is received.

- Utilizing tools like the Monarch Money and Simplifi budgeting apps can play a fundamental role in adhering to the 50/30/20 allocations, fostering discipline and consistency in financial routines.

In adherence with the 50/30/20 rule, loan payments — encompassing mortgages, auto loans, and minimum credit card payments — are classified as needs. Any additional payments made beyond these minimums are considered part of savings or ongoing debt reduction, illustrating the rule’s versatility in addressing different forms of financial commitments.

Ultimately, while the 50/30/20 rule tends to be appropriate for a wide array of income levels and debt circumstances, its innate flexibility allows it to be customized in line with one’s unique financial goals, making it a hallmark of effective financial management and a testament to the insights offered in Elizabeth Warren’s book “All Your Worth.”

Understanding Your After-Tax Income and the 50 30 20 Allocation

Grasping the nuances of your after-tax income can profoundly affect your financial planning and the success of the 50 30 20 allocation strategy. To begin, calculating your net income is pivotal. This is the amount that remains once taxes and any other deductions are subtracted from your gross income. This crucial figure represents the financial foundation upon which you can build a stable budget and a resilient savings plan.

Allocation percentages are at the heart of the 50 30 20 rule, advocating for a percentage breakdown that directs half of your after-tax income towards needs, 30% towards wants, and the remaining 20% towards savings. This rule aims to harmonize necessities with personal indulgences while steadfastly building financial reserves.

Notably, the application of the 50 30 20 rule is not without its hurdles. A percentage of individuals find meeting the allocation challenging due to financial constraints, provoking deviations from the recommended percentages. Meanwhile, others may adjust the allocation percentages to align with unique life situations or targeted financial objectives. To illustrate these dynamics, consider the following statistical data:

| Category | Percentage of Income | Impact on Financial Stability | Adherence |

|---|---|---|---|

| Needs | 50% | High | Varies by individual financial constraints |

| Wants | 30% | Moderate | Subject to personal discretion |

| Savings | 20% | Essential for growth | Higher among financially disciplined individuals |

It is evident that adhering to the 50 30 20 allocation can potentially reduce debt and nurture savings, as evidenced by higher average savings amounts among those who strictly follow this rule. Nevertheless, the journey towards financial stability is influenced by distinctive factors, such as variable income structures in certain industries, and an individual’s capacity to adhere to or modify the rule based on demographic aspects or financial stress levels.

To encapsulate, understanding and applying the 50 30 20 allocation to one’s after-tax income is a testament to financial prudence, balancing immediate needs and desires against the imperative of securing one’s future economic wellbeing.

Essential Costs: Allocating the 50% in the 50 30 20 Rule

When it comes to budgeting for essential costs, the 50-30-20 rule offers a practical framework for managing one’s finances. Essential costs encompass those necessary expenses that are non-negotiable, such as housing, utilities, and food. These are the obligations that must be met to ensure survival and maintain a basic standard of living. Keeping budget allocation in check for these costs is critical, as they typically account for 50% of a person’s after-tax income.

The financial challenges presented by inflation, with a 13% increase in the consumer price index over the last two years, means that the average American needs to be even more vigilant about their spending on necessary expenses. With the median annual income in the U.S. being $57,200, and the net income after taxes coming to $39,442, individuals are tasked with a delicate balancing act of managing their bills and dutifully addressing their obligations.

Here’s a breakdown of how the net income would be allocated according to the 50-30-20 rule:

| Category | Monthly Allocation | Notes |

|---|---|---|

| Essential Costs (50%) | $1,643 | Rent, groceries, utilities, transportation, insurance |

| Savings (20%) | $657 | Emergency fund, retirement, debt repayment |

| Everything Else (30%) | $986 | Dining out, hobbies, non-essential shopping |

Despite the guideline suggesting a savings rate of 20%, the average U.S. personal savings rate hovers just above 5%. This is indicative of the struggles faced by many to uphold this essential aspect of the 50-30-20 budgeting rule. Financial experts recommend strategies such as increasing income and reducing large fixed expenses to improve an individual’s budgeting success and savings rate.

The application of this rule can be exemplified by Jenny, who has a monthly income of $3,000 and allocates her budget into $1,500 for essential costs, $900 for wants, and $600 towards savings. For Jenny, ensuring her essential expenses like rent, groceries, and car payments do not exceed 50% of her income is crucial for financial balance and peace of mind.

- Review and reduce costs if essential expenses exceed 50%.

- Decrease discretionary spending aligning with 30% of income.

- Begin with manageable savings and gradually increase.

- Stay committed to the 50-30-20 rule for long-term financial stability.

Ultimately, adherence to the 50-30-20 rule serves as a solid foundation for anyone seeking financial peace of mind, accumulation of wealth, and a more secure financial future.

The 30% Spending: Balancing Wants with Financial Discipline

The equation of balancing wants with financial discipline becomes a sophisticated art under the 50-30-20 rule. The allocation of 30% of after-tax income towards personal enjoyment—often categorized as discretionary spending—may at first glance seem straightforward. However, diverging personal preferences and the lure of nonessential expenses can turn budgeting into a nuanced challenge. This allocation, designed to cater to life’s pleasures, should nevertheless echo the cornerstone of prudent money management.

To illustrate, consider Ben, a diligent practitioner of the 50-30-20 rule, who channels 30% of his $4,000 monthly income—that is, $1,200—towards what brings him joy and satisfaction. However, the rule accentuates not the acts of spending themselves but the importance of constraint within indulgence. It’s vital to recognize that these funds are not a license for unchecked expenses, but rather a designated part of a balanced financial plan.

The essence is not to curb joy but to prevent the creep of want into the domain of financial jeopardy. An accessible emergency fund, regularly contributed to retirement accounts like IRAs and 401(k) plans, strengthens the financial fabric, ensuring personal cravings don’t unravel one’s future stability.

One’s personal budget realities must be acknowledged—an exercise in customization rather than strict adherence to static percentages. The rule is a flexible guideline to provide structure, promoting essential reflection on spending patterns. Individuals must meticulously track incomes and expenses; thus, diligent record-keeping paves the way for fruitful implementation of this principle, aligning one’s fiscal trajectory with long-term aspirations.

In America, where the average personal savings rate often dips below 10%, the aspiration to optimize the 30% for wants necessitates conscious strategizing of expenditures. For someone with a net income of $5800, the ideal budget would suggest $1740 for wants. However, a real-life scenario may depict an imbalance, necessitating adjustments to recalibrate the spending ratio in accordance with the 50/30/20 rule.

Intuitively, the guideline fosters financial discipline by setting boundaries against nonessential spending, advocating for investment in one’s financial future. Sen. Elizabeth Warren and her daughter Amelia Warren Tyagi underscored this in their influential work, “All Your Worth,” championing a simplified financial planning approach that concentrates on three main spending categories as opposed to a complex, itemized budget.

Ultimately, the 30% portion of the rule earmarked for wants must be respected, characterized by discretionary spending that aligns with one’s values and long-term financial discipline. It’s a balancing act, requiring both the wisdom to enjoy today’s life luxuries and the foresight to prioritize tomorrow’s security.

Why Savings Should Never Be an Afterthought

The importance of savings is an indispensable pillar of personal finance, yet often undervalued in the pursuit of immediate gratification. The 50-20-30 budget rule, a guiding principle for many, earmarks 20% of after-tax income for savings, underscoring that building financial security is not sporadic but requires a systematic approach. Automating monthly transfers to a savings account ensures that saving remains a steadfast habit, potentially fortifying one’s emergency fund and contributing to financial stability.

It’s about more than just storing money away; it’s about optimizing savings for future growth. Regular review of the Annual Percentage Rate (APR) on savings accounts, as well as considering high-yield options like CDs or money market accounts, can substantially bolster one’s financial portfolio. In today’s digital age, personal finance apps like Bright Money play a pivotal role, offering personalized strategies and clever insights derived from data science to help users achieve their future goals more efficiently.

The avoidance of carrying a credit card balance is another cornerstone of savvy financial planning. By paying off debts promptly, not only do we liberate funds for further savings, but also we evade the compounding interest that can encroach on the potential growth of our reserves. Similarly, engaging in employer-sponsored 401(k) plans is an astute move toward retirement planning, especially when benefits such as employer matching contributions are factored in, that help the savings to accumulate at an accelerated pace.

Here are ways to remain steadfast and practical in your savings journey:

- Utilize budgeting apps that tailor savings goals and offer actionable tips.

- Ensure a consistent savings regime that not only fosters wealth but also promotes disciplined financial practices.

- Adhere to budget percentages that assign priority to savings, like the balanced money formula of the 50/30/20 rule.

- Appropriately allocate funds for housing costs and debt payments, all while managing to set aside money for unanticipated home maintenance.

- Explore options for life insurance to protect against unforeseen loss, adjusting coverage to individual financial needs and objectives.

- Proactively save for higher education expenses, aligning with recommendations to save a portion of total anticipated costs.

- Strive to reach retirement savings that echo a substantial percentage of preretirement income to ensure a comfortable living standard later in life.

Amid statistics that reveal a concerning 59% of Americans live paycheck to paycheck, and a staggering 69% have less than $1,000 in savings, the reality of financial fragility is palpable. The predilection for carrying credit card debt and responding to financial strain with side hustles strikes a chord with dismay; savings must ascend from being an afterthought to a deliberate, proactive commitment. In our collective quest for autonomy and tranquility in our personal finances, establishing steadfast savings strategies is not merely beneficial—it is essential for survival and growth.

Practical Tips to Apply the 50 30 20 Rule Correctly

Optimizing your budget requires more than just knowledge of the 50/30/20 rule; it demands consistent action and practical applications. To reap the benefits of financial success, it’s crucial to commit to applying the rule and engaging in disciplined budget tracking. Consider these real-world strategies that can fortify your financial framework:

- Budget Tracking: Begin with an in-depth analysis of your monthly income. Allocate 50% of your post-tax earnings to needs, 30% to wants, and 20% to debt and savings. By itemizing your needs, you’ll have a clear picture of where your finances stand and how well you adhere to the 50/30/20 distribution.

- Automated Payments: Automate your savings and debt payments to eliminate the temptation of skipping or delaying them. This tactic ensures the 20% dedicated to your financial goals is always prioritized.

- Setting Financial Goals: Identify your short-term and long-term financial ambitions. Keeping these goals in mind solidifies your commitment to following the budgeting tips integral to the 50/30/20 rule.

Critical to the practice of applying the rule is understanding its implications through relevant data. Here’s how individuals and industries are affected by the correct implementation:

| Aspect | Successful Adherence | Challenges or Failures |

|---|---|---|

| Financial Stability | Enhanced, with a buffer for unexpected expenses | Compromised, leading to vulnerable financial health |

| Industry-Specific Adherence | Varies, with some sectors showing higher compliance | Disparities in understanding and execution of the rule |

| Financial Outcomes | Better prepared for retirement and emergencies | Potential risk of lifestyle downgrade post-retirement |

| Goal Achievement | Effective in meeting financial targets | Hindered progression toward financial milestones |

Adopting budgeting tips leads to a fortified financial standing. As stated by the Boston College Center for Retirement Research, roughly half of American families currently face the threat of a lower standard of living during retirement. This statistic underscores the importance of employing a strategy like the 50/30/20 rule to avoid such pitfalls.

Enhance your odds of financial success by being among the diligent percentage applying the rule accurately, rather than amongst those not optimizing their financial practices. Let these actionable insights navigate you towards a robust financial future—one where your needs, wants, and future are all responsibly accounted for.

The Role of Net Worth in the 50 30 20 Rule

Understanding and managing one’s net worth is a critical element of maintaining robust financial health, and it is intricately linked to the effective application of the 50/30/20 budgeting rule. Calculating net worth involves assessing assets and liabilities, with the goal being to foster wealth accumulation over time. While adhering to the 50/30/20 rule’s guidance on allocating after-tax income – 50% to needs, 30% to wants, and 20% to savings or debt – individuals can work towards increasing their net worth and achieving financial stability.

Given that assets can include savings accounts, investments, and property, and liabilities may encompass mortgages, credit card debt, and other loans, it’s essential that the 20% allocated for savings or debt is strategically used to pay down liabilities and elevate one’s net worth through asset growth. It’s important to recognize that situations can vary greatly; for individuals with a monthly income of $6,000, the 50/30/20 breakdown leads to $3,000 for needs, $1,800 for wants, and $1,200 for savings and paying off debt. The allocated 20% for savings or debt is designed to cover more than just the minimum payments on debts like credit cards or mortgages, thereby facilitating wealth accumulation by reducing liabilities.

The simplicity of the 50/30/20 rule lies in its minimalist category structure, yet, the one-size-fits-all approach may not suit everyone, especially for those in high-cost living areas or individuals with a larger disposable income. In some cases, 50% might not suffice for needs, whereas high-income earners may find themselves allocating excessively to wants. Therefore, the percentages might need adjustments to tailor personal financial health plans that cater to unique circumstances, promoting a steadier climb in net worth.

Despite some critics of the rule suggesting that it doesn’t fit every financial scenario, many agree on the overarching principle that strengthening one’s net worth through smart asset and liability management is paramount. Regardless of the budgeting methodology applied, the fundamental idea remains to fortify financial security through deliberate wealth-building steps, such as establishing an emergency fund to manage unexpected expenses and contributing towards retirement savings regularly to avoid a potential decline in living standards post-retirement.

- Assess after-tax income and categorize it under needs, wants, and savings/debt repayment.

- Determine regular expenses for needs and wants and compare against the suggested 50/30 percentages.

- Use the allocated 20% towards reducing liabilities and strengthening savings — both key players in increasing net worth.

- Reevaluate and adjust the budget as needed to resonate with personal goals focused on steady wealth accumulation.

- Implement practical steps towards wealth building by gathering financial statements, categorizing expenses, and evaluating the results for any necessary adjustments.

Adherence to the 50/30/20 rule not only provides a framework for managing monthly budgets but also serves as a guideline for enhancing one’s financial foundation. By allocating resources towards reducing debt and increasing savings, individuals can influence their net worth positively and navigate towards a more secure financial future.

Overcoming Common Challenges in Applying the 50 30 20 Rule

Applying the 50-30-20 Rule can often bring to light various challenges and budgeting obstacles, especially when personal debt in the U.S. has been on an alarming incline, reaching over $4.5 trillion. The hurdles of staying on track, curtailing impulse spending, and avoiding lifestyle inflation require dutiful attention and strategic actions. One must be vigilant in adjusting allocations to ensure that each dollar serves a purpose towards financial equilibrium.

Inclined to control spending behaviors, cash users have found a stalwart ally in the “envelope” system, a proven methodology to mitigate overall expenditure as opposed to the liberal use of credit. On that note, budgeting apps and software programs act as pivotal tools in this digital era, granting users the power to meticulously track spending across common categories such as housing, transportation, and groceries.

Notably, an August 2023 report highlighted that about 2.4 million households failed to pay at least one essential bill, indicating a widespread difficulty in managing finances. To counteract such prevailing issues, here’s a look at practical stratagems:

- Envelope System: Allocate cash for varying expenses to curb overspending.

- Budgeting Software: Leverage digital means to track expenditures and avert financial pitfalls.

- Clear Debts: Focus on paying off debts before channeling funds into savings, given the higher interest rates incurred by loans and overdrafts.

- Automatic Savings: Ensure the seamless transition of income into savings by setting up automated transfers, recommended to be at an unwavering rate of 20%.

The battle against impulse spending is relentless, but the assiduous use of budgeting applications can act as a bulwark against erratic purchasing patterns. Meanwhile, lifestyle inflation remains a perennial threat, often sneakily eroding the firmness of well-intentioned budgetary constraints. To offset such tendencies, it is advisable to revisit and adjust budget allocations routinely, ensuring that financial goals retain their sanctity.

While the expedience of credit cards charms many, the wisdom in budgeting lies in the capacity to clear balances monthly to avert accruing interest. The ethos of the 50-30-20 Rule—segmenting income into needs, wants, and savings—is not merely about delineation but a philosophy that when adhered to diligently, manifests financial discipline and foresight.

In culmination, the challenges encountered in the application of the 50-30-20 Rule are not insurmountable. They demand a blend of traditional budgeting techniques, complemented by modern technology aids, coupled with an unyielding commitment to financial prudence.

Adapting the 50 30 20 Rule for Financial Prosperity

To pave the way for financial prosperity, it is essential to consider both the established norms of budgeting and the personal nuances that come with income variations. The conventional 50-30-20 budgeting rule serves as a baseline for organizing one’s finances. This method is a proven approach for many but it may require customized budgeting to accurately reflect an individual’s unique personal finance goals.

Gone are the days when one-size-fits-all financial advice could apply to everyone. With lifestyles and careers becoming more diverse, the need for specific financial goals and plans has become more evident. A family in Boise, Idaho, may find their necessities consuming over 71% of their take-home pay, compelling them to seek a budget that allows greater flexibility. Similarly, an individual in a high-cost living area, like Chicago, might struggle to allocate only 50% of their income to needs.

Here are some statistics that elucidate the current economic backdrop:

- The median annual income for a single American is $57,200, with a net income after taxes at approximately $39,442.

- The average savings rate is just over 5%, a figure below the recommended 20% savings mark, indicating a potential gap in financial security.

- Necessities such as rent, averaging $1,495 for a one-bedroom apartment, and other expenses like car payments and groceries, can quickly add up to more than 50% of one’s net income.

Given these statistics, the traditional 50-30-20 allocation – 50% to needs, 30% to wants, and 20% to savings – may not be attainable for all. Therefore, individuals may consider automating their savings and scrutinizing their budgets with tools like Mint to ensure they manage their resources wisely. This level of customized budgeting is vital in the quest for financial prosperity.

In conclusion, while the 50-30-20 rule offers a robust framework for managing money, it’s important to approach it with adaptability. Tailoring this budget to your circumstances by accounting for income variations, setting specific financial goals, and building in flexibility can make this rule a powerful tool in achieving personal finance goals and overall financial well-being.

Conclusion

In summary, the 50-30-20 rule emerges as a fundamental framework for achieving a balanced financial life. By allocating after-tax income into distinct categories—50% for essentials like housing and groceries, 30% for personal enjoyment such as dining out, and 20% for savings and debt repayment—individuals can maintain financial stability while indulging responsibly. The rule’s adaptability allows for personalization to fit various income levels and lifestyles, making it a versatile tool in financial planning.

Key takeaways from our exploration of this budgeting method include the importance of committing to saving at least 20% of after-tax income, which echoes expert recommendations of a six-month emergency fund. The detrimental impact of high-interest debt also underscores the necessity of incorporating debt reduction into one’s financial strategy. The use of smart budgeting tools like Moneyscope.ai offers an effective means for individuals to oversee their financial health, ensuring they keep track of expenses and work towards their goals.

As we conclude, it’s evident that the true power of the 50-30-20 rule lies in its simplicity and flexibility. Whether it’s saving for retirement with vehicles like an IRA or a 401(k) with employer matching, or customizing the rule to accommodate unique financial circumstances, this budgeting strategy serves as a compass guiding us towards a more secure and enjoyable financial future. The implementation of this rule, backed by mindful planning and discipline, can transform the theoretical into the actionable, paving the way for financial success.